The May 1983 Supreme Court case Bob Jones University v. United States established that tax-exempt status under Section 501(c)(3) of the Internal Revenue Code is contingent upon an institution’s adherence to fundamental public policies. In this landmark case, the Court upheld the IRS’s decision to revoke Bob Jones University’s tax-exempt status due to its racially discriminatory policies, emphasizing that such discrimination is contrary to established public policy and thus disqualifies an institution from tax exemption, regardless of religious motivations. At the time, President Ronald Reagan sided with Bob Jones University not the IRS. Bob Jones University regained its tax-exempt status in 2017 after Bob Jones III publicly renounced earlier admissions policies in 2008.

Fast forward to 2025. A similar debate has emerged involving another private university—Harvard—and the federal government. The current administration has threatened to revoke Harvard’s tax-exempt status and freeze substantial federal funding, citing the university’s alleged failure to adequately address antisemitism and its resistance to federal demands concerning campus activism and diversity programs.

Harvard has firmly rejected these demands, asserting that compliance would infringe upon its constitutional rights and institutional autonomy. A history of antisemitism at Harvard since the 1920s was discussed by author Jerome Karabel in the 2006 book The Chosen: The Hidden History of Admission and Exclusion at Harvard, Yale, and Princeton. In January 2025, the university settled two Title VI lawsuits around antisemitism.

While both situations involve the federal government leveraging tax-exempt status to enforce compliance with public policy, the contexts differ significantly. The Bob Jones case centered on explicit racial discrimination, a clear violation of public policy. In the case of Harvard, historically, the courts have protected First Amendment issues such as academic freedom and free speech on campus. The move by the current administration represents a significant change.

The outcome of this contemporary conflict may further define the boundaries between governmental authority and institutional independence in higher education. It raises profound questions about who determines “fundamental public policy” in an increasingly polarized era, and whether tax-exempt status should be used as leverage to influence university policies on complex social and political issues.

As this situation unfolds, university administrators, legal scholars, and policymakers across the political spectrum are watching closely, recognizing that the precedent established could reshape the relationship between the federal government and higher education institutions for decades to come.

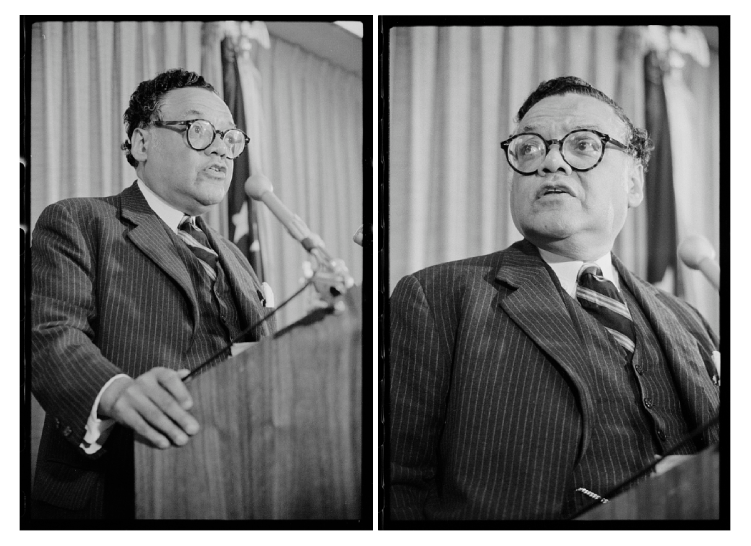

Photo credits: Harvard by Wikimedia Commons, Coleman by Library of Congress